Offshore used to be a taboo word in the financial industry, but not anymore. Countries around the world have made entire industries by providing exceptional financial advice and services to their clients. These services range include Tax advice, asset protection, Financial security and privacy protection; services that Sandstone Tax specialise in.

Despite what the media would have you believe, there are various legal and legitimate reasons to setup and use an offshore company.

- Financial Privacy and Safety.

- Lower Tax Burdens and High Interest Rates

- Business Opportunities

- Secure Financial Sectors

- Access to Experts

- Robust Legal Frameworks

- Protection from Litigation

Financial Privacy and Safety

Privacy Is a human right, and the stigma associated with Offshore companies is that people want to hide their money. This is not always the case.

Just because something can be used for immoral purposes, does not make it an immoral act by default. There are many reasons as to why someone may want to use an offshore structure to provide them that additional levels of privacy and safety.

Many of our clients come from countries and jurisdictions where the privacy can be compromised, and their wealth can be disclosed and used as a mechanism to threaten them.

In a situation like this somebody might want to set up an offshore corporation to add an additional layer of privacy and protection for their operations. They may just be trying to protect themselves and their family.

Lower Tax Burdens

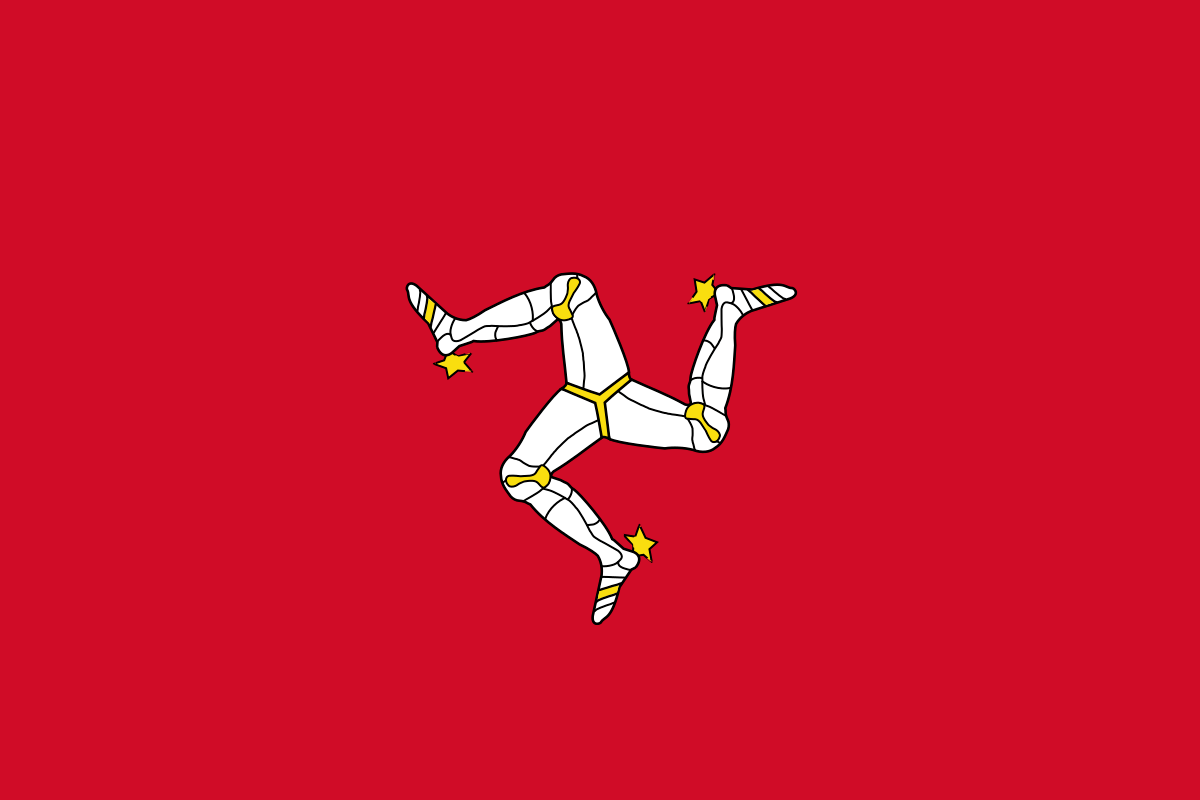

One of the key benefits to using an offshore company is that these countries have reduced their corporate and personal tax rates to a minimum. The Isle of Man for example has a standard corporate income tax rate of 0%. That means that you will not pay any corporation tax in the offshore jurisdiction Whether you have to pay tax on the offshore corporate profits in your domestic jurisdiction depends on the tax laws of that country. Because of changes in international taxation, it is unlikely that you will be able to hide these profits from your local tax authority. Hence, the need to get proper tax advice.

Often offshore companies are used as they are tax neutral. For example, if two international businesses want to do a joint venture, it is often easier to structure this in an offshore company where each party pays tax at home according to their own local tax laws.

Business Opportunities

Having an offshore company will provide you opportunities and platforms for collaboration with companies for mutual benefit. By having very robust tax mechanisms in place there is a high concentration of major organizations that have their headquarters located in these countries.

Another major advantage to this is that it provides access to financial instruments that provide better returns than domestic financial instruments.

Secure Financial Sectors

The financial sector in the Isle of Man makes a contribution of 64% of the GDP. The financial sector is a fundamental driver and growth mechanism for the country. Due to this the Isle of Man has a special interest in the Financial Industry, and you can rest easy in the knowledge that you will not face and backlash from the financial conditions or limitations of your own country.

Additional benefits are with low tax payments and unmatched business opportunities, you protect yourself from any fluctuations or instability in your own country as the corporate funds are secured offshore.

Access to Experts

As the cornerstone of the Isle of Man economy, the Financial sector are adept in understanding and providing you with specialist bespoke solutions that you would not otherwise be able to find.

Sandstone Tax are experts in this area and ensure each and every client get the bespoke, boutique treatment that ensures they are provided with industry leading services and advice.

Robust Legal Frameworks

Setting up an offshore company will provide you with legal benefits that would not be otherwise available. By utilising an offshore company, you will have access to robust legal frameworks that are clearly defined and provide better operational efficiency. This will provide benefits and enable you to solve any problems in a timely and defined manner that will save you a lot of money compared to the legal framework of your country.

Protection from Litigation

Legal action is something that cannot be avoided and will in most cases be an issue for business owners and companies at some point during their operations.

Registering your offshore company in a location like the Isle of Man reduces the risk of your companies’ assets coming under scrutiny since they now lie outside of your home countries jurisdiction. This is a layer of protection between you and your business.

Sandstone Tax does not setup offshore companies. Instead we work with our specialist partners in jurisdictions throughout the world. We help determine the best company for your needs and put you in touch with the most appropriate experts. Contact Sandstone Tax today to learn more about how we can get you the most appropriate, bespoke solution to suit your needs.